Buyer & Seller Perks in Todays Housing Market

Right now, the housing market is full of outstanding opportunities for both buyers and sellers. Whether you're thinking of buying your first home, moving up to a bigger one, or selling so you can downsize this spring, there are perks today that are powering big moves for people across the country. Here are the top two to keep on the radar this season.

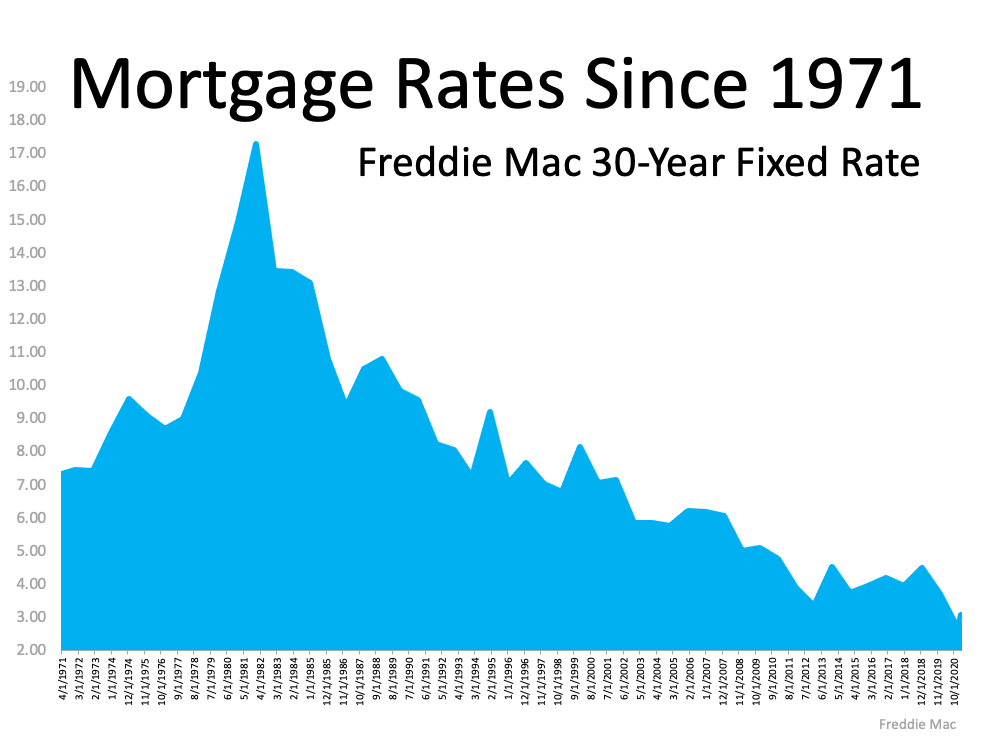

The Biggest Perk for Buyers: Low Mortgage Rates

Todays most compelling buyer incentive is low mortgage interest rates. The 30-year fixed-rate is now averaging just over 3%. While that's slightly higher than the record-lows from 2020 and earlier this year, its still way lower than historic norms, making purchasing a home an ongoing perk for hopeful buyers (See graph below): This is a huge advantage for buyers and helps to make owning a home attainable for more households and there's good reason to strive for homeownership. The latest Homeowner Equity Report from CoreLogic shows how homeowners saw major gains in their net worth last year, all thanks to owning a home. Frank Martell, President and CEO of CoreLogic, explains:

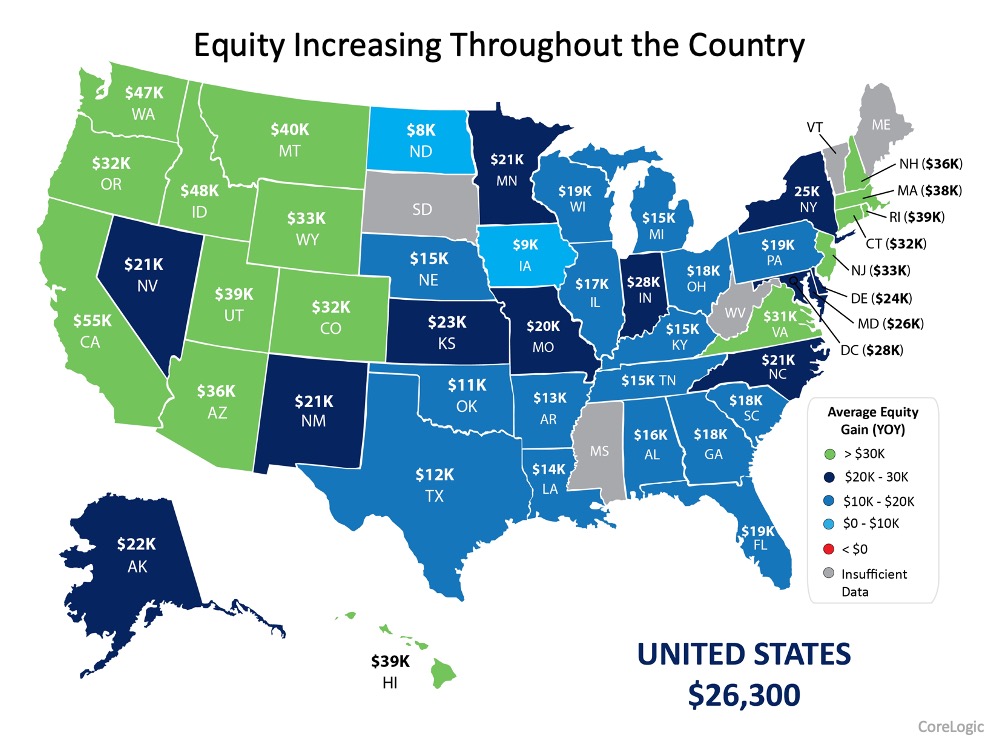

This is a huge advantage for buyers and helps to make owning a home attainable for more households and there's good reason to strive for homeownership. The latest Homeowner Equity Report from CoreLogic shows how homeowners saw major gains in their net worth last year, all thanks to owning a home. Frank Martell, President and CEO of CoreLogic, explains:

Positive factors like record-low interest rates and a booming housing market encouraged many families to enter homeownership. This growing bank of personal wealth that homeownership affords was noticed by many but in particular for first-time buyers who want a piece of the cake. As a result, we may see more of those currently renting start to enter the market in the near future.

Low mortgage rates are a plus for buyers right now, but experts forecast well see them continue to rise as the year goes on. If you're ready to purchase a home, its wise to get started on the process soon so you can secure todays comparatively low rate.

The Biggest Perk for Sellers: Low Inventory

Today, there are simply not enough houses on the market for the number of buyers looking to purchase them, and its creating a serious sellers market. According to Danielle Hale, Chief Economist at realtor.com:

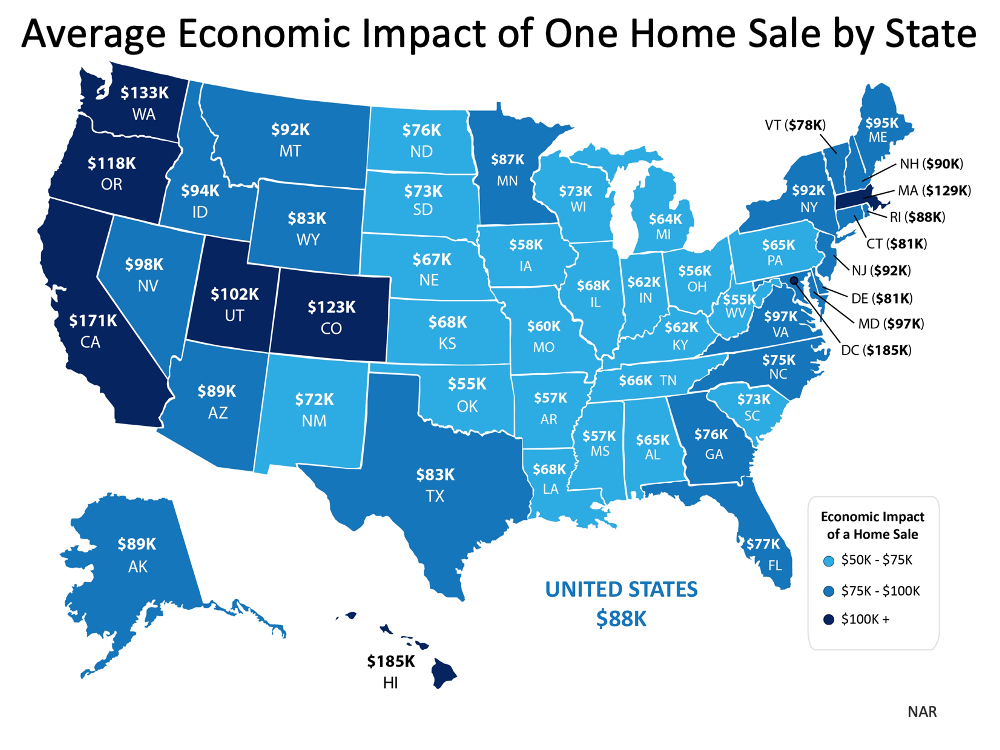

Total active inventory continues to decline, dropping 50 percent. With buyers active in the market and sellers still slow to put homes up for sale, homes are selling quickly and the total number actively available for sale at any point in time continues to decline. (See map below):

The lack of houses for sale continues to challenge the market, and with low mortgage rates fueling buyer demand, homes are hard for buyers to find today. According to the latest Realtors Confidence Index Survey by the National Association of Realtors (NAR), the average house is now receiving 4.1 offers and is on the market for only 20 days.

The lack of houses for sale continues to challenge the market, and with low mortgage rates fueling buyer demand, homes are hard for buyers to find today. According to the latest Realtors Confidence Index Survey by the National Association of Realtors (NAR), the average house is now receiving 4.1 offers and is on the market for only 20 days.

Buyers are clearly eager to purchase, and because of the shortage of inventory available, they're often entering bidding wars. This is one of the factors keeping home prices strong and giving sellers leverage in the negotiation process.

Homeowners who are in a position to sell shouldn't wait to make their move. There's a light at the end of the tunnel for todays inventory shortage, so listing this spring will get your house on the market when conditions are most favorable. With low inventory and high buyer demand, homeowners can potentially earn a greater profit on their houses and sell them quickly in the fast-paced spring market.

Bottom Line

Whether you're thinking about buying or selling a home, there are major perks available in todays housing market. Lets connect today to discuss how these favorable conditions play to your advantage in our local area.